Feb 26, 2019 | Constitution, Economy, Healthcare, Liberty Articles, Taxes

By Harold Pease, Ph. D.

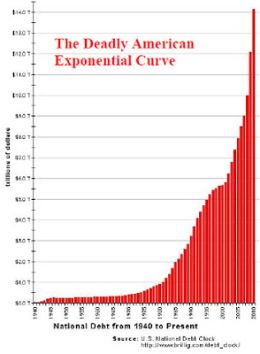

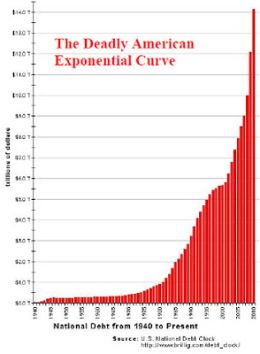

Our national debt just exceeded 22 trillion dollars. To pay this debt today each citizen owes $67,033. Since children pay no taxes, nor do about 45% of our adult population, each taxpayer actually owes $179,908. Our largest creditors in order are: Medicare/Medicaid $1,091,280,000,000, Social Security $1,005,651,000,000, Defense/War 676,814,000,000, Income Security (welfare) $293,531,000,000, Net Interest on Debt $350,206,000,000, and Federal Pensions $272,980,000,000 (USDebtClock.org).

Even with the present robust Trump economy (the best in several decades) this cannot continue to escalate. We are on a collision course with Armageddon which, at this late date, may not be avoidable. Any hope depends on three things (1) our ability to make significant cuts in the top six expenditures noted above, (2) our not electing a big spending congress or president in the next decade, (3) our not entering into any new big funding events such as war, infrastructure overhaul, or open borders allowing new groups to “eat out our substance” without having already paid their way.

Of this enslaving debt, four trillion comes from eight years of George W. Bush and ten trillion from eight years of Barack Obama—the two biggest spending presidents in U.S. History. Obama alone accumulated more debt than all previous presidents put together. Donald Trump is responsible for over two trillion dollars in two years.

So what is a trillion dollars? To begin with a trillion is the number one followed by twelve zeros. A trillion dollars is a thousand billion and a billion is a thousand million. This still means very little to students who count their money in fives, tens and twenties.

One mathematician gave us a more practical way to evaluate our outstanding debt. One trillion, one-dollar bills stacked atop each other (not end to end but flat) would reach nearly 68,000 miles into space—a third of the way to the moon (See CNN News Cast, Feb. 4, 2009). If so, the debt incurred under President Obama alone, $10 trillion, would have reached the moon and back and to the moon again. Moreover, if you like traveling atop this stack of ones, our total $22 trillion in debt would take you to the moon and back three times and to the moon a fourth time and a third of the way home again.

I ask students, “Who gets to go without so that this debt can be paid?” “Go without!!!?” That is a concept foreign to this generation!! They do not know, and neither do their parents and grandparents who laid it on their backs. When they are told that their share of the debt is $67,034 and up to $179,908, depending on how many of their fellow non taxpayers they can get to pay their fair share (see USDebtClock.org), due immediately, they are angry. Someone should have told them that government handouts are not free.

The 13th Amendment ending slavery has been rescinded, they are America’s new slaves. Bondage was given them before their birth, or while still in the womb, or before they were old enough to know what it meant to be sold into slavery. The past generation wanted nice costly programs for free and were willing to sell their children in order to have them.

The latest new theory to avoid fiscal responsibility and continue unlimited spending, used by Bush in late 2009 and Obama thereafter, is referred to as Quantitative Easing. Crudely it means printing more money out of thin air to cover our debt, but it is far more sophisticated than that. For Bush the money supply was greatly expanded by having the Federal Reserve purchase $600 billion in mortgage-backed securities (Harding, Robin. 3 November 2010, Quantitative Easing Explained. Financial Times). Obama purchased $600 billion of Treasury securities over a six month period of time beginning in November 2010 in what has been called Quantitative Easing or QE2 to distinguish it from QE1, the Bush expansion of the money supply (Cesky, Annalyn,3 Nov.2010, “QE2: Fed Pulls the Trigger” CNNmoney.com. Retrieved 10 Aug. 2011).

The biggest problem with expanding the money supply is that it reduces the value of the money that you have in your pocket. Prices go up. My Camaro, purchased in 1968, cost $2,700, purchased today at least ten times as much. In this instance money has lost 90% of its value since 1968. Those on fixed incomes are robbed as surely as if a thief had lifted their wallet or purse. They cannot return to their employer for a raise to compensate for the loss caused by their own government.

Still, with all the sophisticated “doublespeak,” as for example quantitative easement, it means that we will print whatever money we need to purchase whatever we wish. Neither party is serious about stopping the debt and removing the bondage that we are imposing upon our children and grandchildren.

Democrats propose “free” college and a salary for everyone, whether they work or not, under their proposed Green New Deal. Donald Trump’s proposed trillion-dollar infrastructure program, also does not suggest a change. Who cares if our debt of dollar bills stacked upon one another can go to the moon and back almost four times so long as the government fills our stomachs and, in the case of Obama, purchases our cell phones

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.

Feb 18, 2019 | Constitution, Economy, Liberty Articles, Taxes

(Presidents’ Day, Article)

By Harold Pease, Ph. D

Perhaps America’s most beloved and respected president was Abraham Lincoln, who now shares a national holiday—Presidents Day—with George Washington. Today most Democrats would oppose him, as they once did in 1860. He opposed slavery and socialism. He saw nothing in the Communist Manifesto, published in 1848, worthy of emulation.

On the ownership of property Abraham Lincoln’s feelings were especially strong, he said, “Property is the fruit of labor; property is desirable; is a positive good in the world. That some should be rich shows that others may become rich, and hence is just encouragement to industry and enterprises” (The Collected Works of Abraham Lincoln edited by Roy P. Basler, Volume VII, pp. 259-260). Lincoln might have added “which produces jobs for those not rich.”

To him there was no need to take by force the wealth of those who produce and give it to those less productive, as has always been the prescription of socialism. The “share the wealth” philosophy of socialism brought on by “envy politics,” so articulated by the Democratic Party today, was a foreign ideology to the Civil War president, who had read and rejected Karl Marx’s Communist Manifesto.

The answer to ending poverty is not class envy, first identified by Aristotle some 2,500 years ago as being the natural inclination of those with less, a philosophy implemented by Lenin in Russia when the communists identified those holding property as enemies of the state and liquidated some four to eight million farmers, the “Kulaks” (“The Russian Kulaks,” InDepthInfo.com). Then, they wondered why the country had such a horrific famine in 1921-1922 when millions starved.

No money was set aside for, or provided to, any class or special interest group in our Constitution. The power distributed benefited all equally and at the same time. The federal role was as referee only. Our Constitution does not redistribute wealth; it leaves the individual to do that for himself by his work ethic. It remains the fairest way.

Will income inequality be the outcome? Yes! Free men are not equal and equal men are not free. But all will have more under capitalism than had we instead forced income equality by taking from those who produce and giving it to those who do not. We remain anxious to share our wealth producing philosophy with our less prosperous neighbors and the world so that all can have more, but individuals stealing it from us, or using the government to do it for them, known as legalized plunder, is just wrong and disincentivizes those who produce.

Lincoln’s answer to the poor, from which he sprang himself, “Let not him who is houseless pull down the house of another, but let him labor diligently to build one for himself, thus by example assuring that his own shall be safe from violence….” Unfortunately, many in our society have forgotten the “labor diligently” part of his phrase and have come to expect the government to provide, from the industry of others, their every need. On that score Lincoln said sarcastically. “You toil and work and earn bread, and I will eat it.” He viewed this principle as a form of tyranny/slavery on those who work. Today approximately 47% of the adult population pay no federal income tax; many actually receive benefits for which they have paid nothing.

Watching others acquire wealth was, in fact, a sign of a healthy economy for Lincoln. “I take it that it is best for all to leave each man free to acquire property as fast as he can. Some will get wealthy. I don’t believe in a law to prevent a man from getting rich; it would do more harm than good.” Nor would he have supported the hundreds of laws that we have today that disincentivizes a man trying to acquire wealth.

His view sounds similar to those expressed by President Trump in his 2019 State of the Union Address. “Here, in the United States, we are alarmed by new calls to adopt socialism in our country. America was founded on liberty and independence — not government coercion, domination and control. We are BORN FREE, and we will STAY FREE. Tonight, we renew our resolve that America will NEVER be a socialist country.”

The new calls for socialism in our country referenced above were recently dropped by Rep. Alexandria Ocasio-Cortez’s long-awaited Green New Deal endorsed by recently announced Democratic presidential candidates, Senators: Kamala Harris, Elizabeth Warren, Cory Booker and Kirsten Gillibrand seemingly each attempting to “out socialize” opponents.

Paying the estimated $7 trillion price tag required would result in a 90% tax take which, ironically, is the definition of slavery—the very thing Lincoln is credited as having ended. It would end air travel and radically effect every other aspect of life. It would also redistribute vast new sums of less valued printed paper money making all equally poor.

Socialists may hate the “Walmarts” or the “McDonalds” all they want, but these provide the poor tens of thousands of jobs. Do not bite the hand that feeds you, then wonder where the jobs and prosperity went, as did the early Russian socialists. The “share the wealth” philosophy, which Lincoln opposed, and endorsed now by the Democratic Party, has never brought long term general prosperity for any people, any place, or any time.

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.

Jan 23, 2019 | Constitution, Healthcare, Liberty Articles, Taxes

By Harold Pease, Ph. D

Mid December 2018, Judge Reed O’Connor, a U.S. District Judge for the Northern District of Texas ruled that the Tax Cuts and Jobs Act last year ending the individual mandate’s penalty, which is the heart of Affordable Care Act, also made Obamacare unconstitutional without it. Nineteen other state attorneys general joined in the lawsuit Texas v. Azar. Likely this is headed to the Supreme Court.

But the Supreme Court essentially resolved this question June 2012 with the same five to four composition of the Court that now exists, when Justice John Roberts changed sides ruling that the individual mandate was a tax, not a fine, therefore making it constitutional, a position denied by Democrats previously. But it saved Obamacare. Justice Roberts could be again the deciding vote. If he betrays original intent of the Constitution, as before, he may again do heavy damage to the Constitution.

Prior to Roberts unanticipated vote, Anthony M. Kennedy had been the unpredictable swing vote on the Court. Justice Kennedy, not happy with the Roberts’ switch saving Obamacare, said: “The court majority regards its statutory interpretation as modest. It is not.” Then, not hiding his distain for it added. “It amounts to a vast judicial overreaching. It creates a debilitated, inoperable version of health care regulation that Congress did not enact and the public does not expect.” He called it “judicial legislation” and accused Chief Justice John Roberts of trying to “force on the nation a new act.”

Judicial activism is when a law of Congress is interpreted by the Supreme Court in such a way as to give it new meaning, which is what Justice Roberts did. George Washington warned in his Farewell Address of the inclination of government to do so. “Let there be no change by usurpation; for though this, in one instance, may be the instrument of good, it is the customary weapon by which free governments are destroyed.” Usurpation, in his day meant twisting things around to extract meaning that was initially not there.

So what did Justice Roberts twist, or legislate, that changed the National Affordable Healthcare Act (Obamacare) as passed by Congress? At the top of the list, his rewrite called it a tax when Congress never passed it as a tax and the political party passing it, and their President, Barack Obama, emphatically resisted any description of it as such.

Rich Lowry, a political commentator, said it best. “Obamacare as passed by Congress had a mandate to buy health insurance and a penalty for failing to comply. Obamacare as passed by the Supreme Court has an optional tax for those without health insurance. Obamacare as passed by Congress required states to participate in a massive expansion of Medicaid, or lose all their federal Medicaid funds. Obamacare as passed by the Supreme Court makes state participation in the Medicaid expansion optional.” In short, “Obamacare as passed by Congress didn’t pass constitutional muster. Obamacare as passed by the Supreme Court didn’t pass Congress” (The Umpire Blinks, by Rich Lowry, The Corner, National Review Online, June 29, 2012).

Judicial Legislation or Activism is not new. The desire for the Court to “legislate” through decisions expressed itself more fully the last sixty years as it attempted to “right” perceived wrongs instead of sending the faulted legislation back to the legislative branch for correction by the peoples’ representatives. By altering legislative law it has moved into state prerogatives such as education, state residency requirements, and imposed federal standards of procedure on local police to name but a few. In broadening its power base, far beyond constitutional restraints, it has almost destroyed the idea of two co-equal governments, one federal the other state, known as federalism.

In the National Affordable Healthcare Act the Supreme Court has effectively restrained further encroachment (mutilation) of the Commerce Clause, formerly used to increase its power, but opened wide the interpretive door that the federal government can control anything it taxes. So, does this mean that if the federal government wishes to control free speech, press, assembly, religion, guns, or any other activity, it first simply levies a tax on that activity? Apparently judicial legislation creates a “need” for additional judicial legislation. God help us!!

We must return to our foundation, the U.S. Constitution as written, without all the judicial or executive alterations that go beyond this document. According to Article I Section I, “All legislative Powers herein granted shall be vested in a Congress of the United States, which shall consist of a Senate and House of Representatives.” There is no authority for either of the two other branches of government to make law—any law— and law made by Congress is specifically listed in Article I, Section 8 where 18 clauses identify the very limited powers of the federal government. So, even Congress cannot make any law they like.

The issue of health is not listed and is therefore, as per Amendment 10, entirely a state issue. The Supreme Court majority ruling ignored this long-term clarity and instead chose to violate the document they are charged with upholding.

Judge Reed O’Connor’s ruling rendering Obamacare unconstitutional may give the Supreme Court a chance to return to the Constitution as written. Unfortunately the deciding vote remains again with Roberts who can’t be trusted constitutionally and so Obamacare could still stand.

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.

Jan 14, 2019 | Economy, Liberty Articles, Taxes

Harold Pease, Ph. D

Hugo Chavez proclaimed December 6, 1998, when he was elected president of Venezuela, “Venezuela’s resurrection is under way and nothing and nobody can stop it.” At the time Venezuela had one of the best economies and highest per capita incomes in Latin America. The lure of socialism, where the government controls and distributes most everything, overwhelmed the country.

Twenty years later three million have fled from Chavez’s “new and improved” socialism and his people are starving. Public latrines are overflowing with urine, escalators do not work, public water systems and street lighting are not reliable and citizens eat from the public refuge. The average citizen has lost 20 pounds in the last several months. Today nearly 90% live in poverty and hyperinflation is nearing a million percent. The once oil-rich country now has the appearance of being war-torn. Socialism destroyed Venezuela.

The lure of socialism, something for nothing, first necessitates villainization of those who have. Those who produce become the “public enemy” class. Once this is accomplished the public, whose numbers are always the majority and poor, support the asset confiscation of those who have and produce—this usually by confiscatory taxes or outright governmental takeover.

The prosperity class is the group that risks capital loss to fund experimentation that produces businesses that results in jobs for the masses. When has a poor man created employment for others? Yes they are profit motivated which sometimes makes the investor more prosperous. That is the carrot that elevates society. But should they miscalculate they are the most hurt. When government makes prosperity unlikely through confiscatory taxes they quit investing. Government is inefficient by its nature. There exists no individual penalty for their mistakes once they are in power. Socialism destroys the creative investment class.

Chavez was right “nothing and nobody can stop it.” Once the productive class is destroyed it is all down hill. Fuera Maduro, the new president, could only offer more of the same socialist remedies that have never worked where socialism has been intrenched.

Beware of politicians who wish to do “good” with someone else’s money. They are abundant in both major political parties but have overwhelmed the Democratic Party, more especially the freshman class led by Alexandria Ocasio-Cortez, and will destroy liberty for us too. Here is why.

Under socialism vote power favors those who want things for free: food, welfare, housing, healthcare—even free college, as they in time become the majority. This process is accelerated, and corrupted, when politicians link government gift giving with being elected. This has happened in America too.

As the poor, as a class, always tend to favor government intervention and thus financial favors from government to their benefit, and since all government money comes from the middle and upper classes through ever increasing taxes, (presently 47% of the adult population pay no federal income tax and a good share of these make up the non-productive class) they eventually destroy the productive base of society as government takes over more of the economy by confiscation or regulation. The overriding principle is, the more socialism the higher the taxes and burden on the producing class.

Those who feed off the labor of others need to know what they are doing to a country by pushing for the “freebies.” An unknown author nailed the problem when he wrote.

“The folks who are getting the free stuff don’t like the folks who are paying for the free stuff, because the folks who are paying for the free stuff can no longer afford to pay for both the free stuff and their own stuff. And the folks who are paying for the free stuff want the free stuff to stop.

“And the folks who are getting the free stuff want even more free stuff on top of the free stuff they are already getting. Now, the people who are forcing the people who pay for the free stuff have told the people who are RECEIVING the free stuff that the people who are PAYING for the free stuff are being mean, prejudiced, and racist.

“So, the people who are GETTING the free stuff have been convinced they need to hate the people who are paying for the free stuff by the people who are forcing some people to pay for their free stuff and giving them the free stuff in the first place.

“We have let the free stuff giving go on for so long that there are now more people getting free stuff than paying for the free stuff.”

Ultimately voters learn that they can purchase members of Congress who will take from those who have and give it to them. Legalized plunder. As those who have are disincentivized to invest further, the poor class grows as does their cry for even more from those who have, thus the managerial and funding class are extinguished. The middle class is now seen as those who have and are next to be extinguished by the increasing strength of the poor class until all remaining are poor. This is Venenzuala now and the United States too soon if it does not change direction.

This is Economics 101 but many freshmen Democrat Congressmen appear oblivious to this. Alexandria Ocasio-Cortez’s advocacy of a 70% income tax on Americans would escalate our economic demise.

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.

Jan 15, 2018 | Liberty Articles, Taxes

By Harold Pease, Ph. D

How many times have I heard said, “The rich need to pay their fair share?” But they already pay almost all of the federal income taxes while the “poor” receive government checks. A quick check with the Congressional Budget Office reveals that the top 20% of wage earners pay over 90% of all federal income taxes while the bottom fifth get more from the federal government than they pay to it. Normally around 45% of adults pay no federal income taxes. The top 40% normally pay it all. This does not change in the new Trump Tax Plan.

What I have written is not found on any news network or newspaper left of center. Why, because communism, socialism and liberalism, of which the left is comprised, share a hatred for the rich (some call it class envy) and believe in income equality as a major tenant of the faith. The government cannot give to anyone that which it has not first taken from someone else. The graduated income tax notion, first published in the Communist Manifesto by Karl Marks and adopted in full by the progressives in this country over a hundred years ago, historically destroys the rich but also in time impoverishes everyone except the ruling elite.

Those on the left normally go ballistic with the above and quickly change the wording from “federal income taxes” to “taxes” (dropping the word federal) noting, mostly correctly, that illegals and other low income peoples pay state and local taxes, perhaps as much as a fifth of their income. These however, are mostly required “use” or purchase taxes, not based upon income levels. Imagine a store having different prices for the same item based upon ones ability to pay. Actually, it is the only fair tax, as one cannot get the gasoline, food or etc. without paying the taxes associated with it. Please note, this column is about federal income taxes not state or local taxes, which are paid entirely by those considered rich by the bottom two-income classes.

Simply stated the bottom fifth of wage earners get more from the federal government than they pay in taxes to it. Such “government transfers” (handouts) come in many forms: food stamps, medical and housing subsidies, and various other subsidized programs including income and child tax credit programs—some tuition credits.

How can this be fair to the class that is forced to help pay their bills? Why shouldn’t the “poor” pay their fair share especially since a large portion of the total is funneled back to them in welfare and the nation is nearing bankruptcy with nearly $21trillion in debt as a result?

We have the normal three solutions in dealing with this debt: tax more, inflate more, and cut more. We could double our taxes but that will destroy our incentive and resources to create jobs. We could inflate the dollar making every dollar already earned worth less as we have done for over 100 years. But that robs those on fixed incomes and seriously damages the lower classes who don’t have the money to purchase gold or silver to ensure the value of what they have saved. Or finally, we could cut the free or subsidized “non-essential” programs and live within our means. But no recipient considers his “gifted” program non-essential.

I suggest a fourth solution? We are becoming a two-class society—those who pay federal income taxes and those who do not, with the non-tax payers still receiving generous subsidies from the pockets of those who do—some say “makers versus takers.” Worse, those who are federal taxpayers are denied these same benefits their less productive neighbors receive. We all have able-bodied friends who choose not to work. How often do we hear of friends who won’t work because they get enough on unemployment or that they might, in fact, make less by working?

Most use federal services in some way? As compassionate as we wish to be with the money of others, in fairness shouldn’t all be required to pay federal income taxes? Even the widow paid her mite in the New Testament and was subsequently praised (not excused) for having done so by Christ himself.

All “freebie” benefits that the “poor” received during the preceding year should be added to their salary in this calculation. When they know this up front they may elect to opt-out of the benefit so that it doesn’t put them in a higher tax bracket. When the “poor” pay federal income taxes they are vested in the system and hypothetically more responsible. When they do not the issue of taxation on the federal level becomes meaningless to them. “So what if taxes are raised, it does not affect me!”

When the non-federal income taxpayer class (presumably the poor) reaches 51% of the population they become the majority class and will never reduce the taxes on the “rich,” which will always be defined as anyone making more than they. The working taxpayer class becomes the new slave class. Eventually when the “rich” are destroyed as a class, as happened in the U.S.S.R. under socialism, all become slaves and poor. With everyone participating in the tax burden, it is harder to gain support for tax raising issues, thus saving billions and the payment of taxes by non-taxpayers, the “poor,” help reduce the national debt.

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.

Jun 13, 2016 | Constitution, Liberty Articles, Taxes

By Harold Pease, Ph. D

As reported, every school district in the country received a May 12, 2016 letter allowing transgender students in public schools to use bathrooms and locker rooms consistent with their chosen (not their actual) gender identity. Those not complying are threatened with lawsuits and loss of federal aid.

This federal pressure to be obedient to federal whim, or in this case a radical reinterpretation of old law, is not new. In the seventies President Richard Nixon had speed limits on freeways reduced to 55 miles per hour, lasting over a decade, because of an alleged energy shortage. After a time a Wyoming governor reposted freeway speed in his state to 65. The governor was right, speed regulation on freeways was not a delegated power listed in Article I, Section 8 nor had such power been added to the federal government by way of an amendment to the Constitution. The federal government threatened loss all federal funds for new construction and/or highway repair for non-complying states. Wyoming returned to 55 mph.

About the same time a new directive, similar to the present Obama transgender directive, required institutions of higher learning receiving federal funds to have open gender housing should students demand it. Brigham Young University (BYU) refused on the basis that as a religious institution male/female dorm separation for singles was a fundamental religious principle. The federal government threatened the University with the loss of all federal funds should it not comply. BYU still refused. Coed dorms is also not a federal power as per the enumeration clauses, again in Section 8, and are therefore totally a state power as per Amendment 10. Actually the word education is not in the Constitution so there exists no federal constitutional authority. The federal government cut off all federal funds to the “rebel” university.

The difference between Wyoming and BYU was that the university had never accepted a dime from the federal government, thus the federal government had nothing to cut off. It had no power to blackmail the institution into compliance. It could, and did, fume and bluster threats but it made no difference. Finding no way to punish the institution itself, it went after the poor students unable to attend without a government guaranteed loan by cutting them off; in time that too was dropped. Enrollment remained untouched as demand always exceeded availability.

Sometime in the late 80’s I was appointed to a special county commission to assess how Kern County of California could deal with all the edicts emanating from the federal government and still be free. It was a strange question. I remained mostly silent as others wrestled in complete frustration with the question, getting nowhere. There seemed to be no solution. Then I asked, “How much slavery have you purchased?” The question was greeted with universal stares and silence, so I asked again. “How much slavery have you purchased?” When you line up for the “free” government money you give the giver power over you because he can cut it off after you have made yourself dependent upon it. “So how much money have you taken because that is what will be cut off should you wish to really run your own county?” “Well, not as much as adjoining Los Angeles County,” came the reply. I had made my point. We were freer than LA County.

The federal government has no constitutional authority to fund anything not enumerated in the Constitution, but it has for decades with nary a complaint from the recipients of the “free” money who lined up like hogs at a feeding trough to receive. Our governors, county commissioners, city councilmen and school administrators have lined up knees bent, palms outreached and open, tongues drooling for the scraps from the table because the “free” money was easier to get than raising local taxes and telling the federal government no.

This without a thought to the “drug” dependency they created for their governments down the road, not noticed until the government asks them for compliance on something that they know is not reasonable or right. Most still will bow their heads in shame but remain in servitude hoping that the next edict will not be so demanding. But they have lost their ability to be independent of their new master—the federal government—that has far more power over them than that imposed by the tiny list of delegated powers in the Constitution. The will of the people they serve is now very much secondary.

In my own profession I have never seen an administrator turn down the “free” money that he used to make himself look better with federal funds because it allowed him to show new buildings or programs as evidence of his excellence. The federal controls that came with it were a small price to pay for the “shiny stuff,” he reasoned. Again, the word education is not in the Constitution but almost every aspect of education is today influenced at the federal level.

My point!! BYU had the right solution to the problem by refusing any federal monies and therefore federal influence. States and communities that didn’t say no to the enticement of “free” money have allowed the federal government to worm her way into all aspects of our lives, a hundred times more than had we stayed with the enumerated powers of the Constitution, to the point that it now tells us where we can go to the bathroom. Sadly we have sold ourselves into dependence. Texas provides the only solution at this point: “the state is willing to forfeit $10 billion in federal education dollars rather than comply.” Will other states and lesser governments follow and break the dependence or continue groveling for the money and more slavery?

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He has taught history and political science from this perspective for over 30 years at Taft College. To read more of his weekly articles, please visit www.LibertyUnderFire.org.