Jul 15, 2019 | Constitution, Economy, Liberty Articles, Taxes

Harold Pease, Ph. D.

As government controls more portions of the economy, democracy transcends to socialism. Sometime in this transition democracy ceases to be democracy although the term continues to be used, and no-one can identify that moment when it is too late to pull free.

So why should the dependent class, defined as the approximately 47% who pay no federal income tax and are largely those who benefit from food stamps, subsidized housing, healthcare and other assistance programs, fear socialism? Because socialism has a history of ending assistance programs. Democracy enables a marriage between the assisted class with their vote power and politicians wishing to empower themselves by, in effect, transferring wealth from those who have to the poor. Once established this marriage self perpetuates and amplifies. Try seeking office today on a platform that ends all governmental assistance programs—or, even just one, food stamps.

The brakes (limits) of the Constitution are powerful when observed but they cannot perform well once gifting (bribing the dependent class for their vote) has been introduced into the body politic. Once ingrained it cannot prevent itself from offering larger and more gifts until elections are bidding wars without constitutional restraints. This feeds an enlarging national debt that can never be paid. We see this today in the Democratic Party presidential debates: free college, reparations for the descendants of ex-slaves, a guaranteed income, and free healthcare for everyone in the world willing to cross our borders illegally. In exchange for your vote the socialist politician advocates that everything be free. This is his most powerful lure and works well on idealistic youth and the already dependent but it risks collapsing the economy, democracy, the Constitution and liberty.

Aristotle recognized this when he wrote, “Republics decline into democracies and democracies degenerate into despotism.” The deadly virus of democracy is voter gifting by politicians willing to sell their souls for elected office.

King Solon of Athens created the governmental form a republic because the philosopher king believed that man should govern himself and, once he had the republic in place, left Athens to attend the University of Alexandria in Egypt never to return. The new idea, personal freedom, resulted in five major unintended consequences: a booming economy, a creative and intellectual surge, an ever enlarging voter base, an unequal distribution of wealth because not all were equally gifted or industrious and, finally, class envy because, although all who worked were comparatively better off from pre-republic standards, some still had more.

The ever enlarging voter base deteriorated into a democracy which had no brakes, no resistance to class envy and the marriage between the expanding less productive who could link their vote with unprincipled politicians willing to transfer the fruits of labor from those who produce to those who do not in exchange for their gaining power. Democracy degenerates into gifting but soon enough there does not exist enough money to sustain the gifting and it ends with an economic crash. Once despotism replaces democracy there are no constitutional checks.

Rome repeated the same experiment with a similar result about a century later. Bread and circuses (free food and entertainment) destroyed the noble idea.

The previous failures were known to the well-read Founding Fathers who wanted the burst in creativity and general prosperity for all as delivered in a republic without the class envy and voter gifting. What if the powers of government were divided and separated into three branches with each a check on the other two and each given a list of the things they could do with gifting excluded? What if all powers not specifically mentioned in Article I, Section 8, remained with the states and the people as stipulated? What if all taxes must be spent only on the items on the list? What if the federal government could not assume additional power without the consent of 3/4th of the states? The government could not take over the economy by confiscation or regulation and the poor could never destroy the rich or devour the middle class. We could never degenerate into democracy then to the most common form of despotism today, socialism—fathered by Karl Marx.

Not a single sentence in the Constitution gives a benefit to anyone, only an environment of equality where one can maximize his talents.

In our republic all votes are not equal. Under the Constitution as designed only the House of Representatives was democratically elected by the people. State legislators voted for U.S. Senators, an Electoral College selected the President, and he appointed supreme court justices for life confirmed only by the Senate.

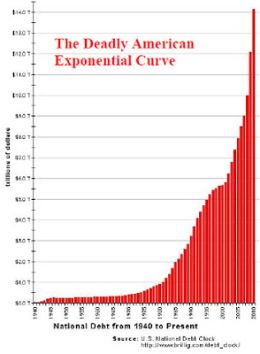

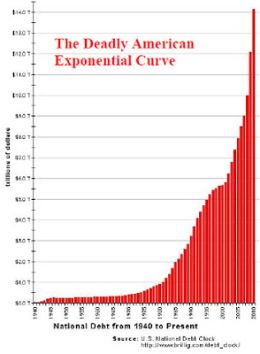

We must apply the brakes of the Constitution to retain our republic. Otherwise in time the productive classes cannot provide the money that is demanded of them to feed and otherwise subsidize the less productive class. It already can’t. We exceed 22 trillion dollars in debt. Each taxpayer owes the federal government $182,881, payable today (See USDebtClock.org). Despite unrealistic promises, socialism gives only slavery and shared poverty.

Gifting must end. When the banks crash a new government will form and it will not honor the debt that destroyed its predecessor government, nor is it likely to fund social security, medicare, unlimited war , income security, federal pensions or any other program that contributed to it. Under socialism freedom does not survive.

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.

Jul 14, 2019 | Economy, Liberty Articles, Taxes

By Harold Pease, Ph. D

Barack Obama, Bernie Sanders and Hillary Clinton, were not the first presidential candidates to introduce socialism into mainstream America. Previous presidents did so and it has been in our diet for most of a hundred years. All twenty Democratic Party 2020 presidential candidates, as per their recent debates, would make militant socialist Eugene V. Debbs, founder of the Socialist Party of America (1901) and five-time presidential candidate, look like today’s conservative republican. Why are many Americans accepting socialism? Because socialism promises everything for free.

Athenian democracy (the “great idea”) profoundly changed the world that was formerly ruled by monarchies; a king stayed in power and passed it on to posterity until removed. It gave ever-larger portions of vote power to the masses but democracy had no brakes. Should everyone have an equal vote? Are they equally informed, equally intelligent, equally gifted? No, but as it expands the next level wants everything as well. Once tasted it enlarges until all have equal participation despite their differences, gifts or ignorance.

Nearly 300 years after democracy was first introduced in Athens, Aristotle (384 BC – 322 BC), wrote of democracy’s inherent weakness, that being, when every man is allowed to rise to the level his talent and industry permit him, some will become rich and others poor. The rich will always despise the poor, and the poor will always envy the rich. When the poor obtain the same vote power as the rich under a democracy, as they always will given their greater numbers, they will use that power to take from the rich.

It may take time for this to happen because democracy does initially encourage the profit motive, which stimulates everyone’s desire to get rich. This is good for society because to do so they invest, creating additional businesses, employing more people, and developing an ever-larger middle class. The middle class, Aristotle believed, should be the ruling class as it is closer to the poor and better understands its legitimate needs and, at the same time, it has enough of the world’s goods not to covet, thus destroy, the rich class. Still, in time the less productive will grow and become more politically powerful, especially as they learn to attach their vote to politicians who, to get elected, promise freebies.

Democracy self-destructed in both Athens and Rome because it had no brakes. Every western civilization history textbook speaks to the “bread and circuses” (free food and entertainment) of Rome.

Thus the Founding Fathers rejected democracy as our form of government in favor of a republic inserting, in their Constitution, the brakes democracy lacked. Today’s enemies of a republic intentionally favor the word democracy over republic because they despise the brakes.

At what moment is society democratized or socialistic enough? As things become freer for the non-productive part of society, more money must be confiscated from the productive middle and upper classes and it is the rich class and entrepreneurial middle class that risk their money to create the jobs making the republic successful. When has a poor man ever created a job for anyone?

In time the productive classes cannot provide the money that is demanded of them to feed and otherwise subsidize the less productive class. They are disincentivized, and then destroyed, by ever-higher taxes. All too soon the definition of rich is lowered until socialism devours the middle class as well—even until all are poor. Despite unrealistic promises, socialism gives only slavery and shared poverty.

Aristotle recognized this when he wrote, “Republics decline into democracies and democracies degenerate into despotisms.” The force to democratize more increases as voting becomes more universal which is what democracies encourage. Shouldn’t everyone have an equal vote? Those in Athens came to believe so. Wrote Aristotle, “Democracy arises out of the notion that those who are equal in any respect are equal in all respects; because men are equally free, they claim to be absolutely equal.”

As voting becomes more universal vote power favors those who seek government favors as they, in time, become the majority. This process is accelerated, and corrupted, when politicians link government gift-giving with their election. As the less productive, as a class, always tend to favor financial favors from government to their benefit, and since all government money comes from the middle and upper classes through ever increasing taxes, (presently 47% of the adult population pay no federal income tax and a good share of these make up the less-productive class) they eventually destroy the productive base of society as government takes over more of the economy by confiscation or regulation. The overriding principle is, the more socialism the higher the taxes and burden on the producing class. Why? Because in exchange for the vote the socialist politician advocates that everything be free. This is his most powerful lure and works well on the idealistic youth and already dependent.

As government controls more portions of the economy, democracy transcends to socialism. Sometime in this transition democracy ceases to be democracy although the term continues to be used, hence Venezuelan President Hugo Chavez’s warning in 2009 to Fidel Castro, both devout socialists, “We have to be careful lest we become right of Obama.” It needs noting that all twenty of the 2020 democratic presidential contenders are far left of Obama, thus decidedly socialists.

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.

Apr 15, 2019 | Constitution, Economy, Liberty Articles, Taxes

Harold Pease, Ph. D

As a nation under the U.S. Constitution we are 230 years old. It may surprise readers to learn that for the first 124 of these years we had no federal income tax and handled our expenses quite well. Today the 55% who pay federal income taxes (77.5 million do not), pay nearly a fifth of their income to the federal government. Prior to 1913 one kept what is now taken from them.

How would you spend it if not taken? You would spend the extra fifth of your salary on thousands of items that are made by others as well as services you might like. This not only would enrich your life but it would provide jobs for others making those items or providing those services. Many middle class folks could purchase a new car every other year with what they are forced to give to the federal government.

Would you spend it more wisely than the federal government? Certainly! Most of the money taken from you by the federal government is spent on perpetual war, foreign aid, grants to privileged portions of our society, and endless unconstitutional subsidized programs; the last two categories of which basically take the money of those who produce and redistribute it to those who do not. Even some non-tax payers get income tax refunds—so corrupt is the system.

Of course, those receiving and benefiting from these programs will defend them. But the fact remains that tax monies provide largely government jobs, which are almost entirely consumption jobs (jobs that consume the production of society but produce little consumable). Such jobs cannot produce for public consumption a potato, a carton of milk, or even a can of hair spray. They bring another person to the table to eat, but not another to produce something to eat.

What largely brought about the give-away programs of the Twentieth Century was the now 106-year-old 16th Amendment—the federal income tax. All three 1912 presidential candidates Teddy Roosevelt, William Howard Taft and Woodrow Wilson, and their respective parties, wanted this financial water faucet that they could turn on at will. With it they could purchase anything—even people.

Prior to 1913 the federal government remained mostly faithful to her grants of power in Article I, Section 8 of the U.S. Constitution, which left them with only four powers: to tax, pay the debts, provide for the general welfare, and provide for the common defense. Because the federal government has the inclination to maximize their authority the last two power grants, general welfare and common defense, each had eight qualifiers to harness them more fully. Outside these qualifiers the federal government had no power to tax or spend.

General welfare then meant everyone equally (general), as opposed to “specific welfare” or “privileged welfare” as it is today, targeting those to forfeit and those to receive monies. The Constitution did not deny states, counties, or cities from having such programs, only the federal government. But politicians soon learned that the more they promised to the people, from the money of others, the easier it was to get elected and stay elected.

The problem with the federal government going off the list and funding things clearly not on it was that each time they did so the stronger the inclination to do so again. One minor departure begets another until one notices that what the federal government does has little or no relationship to the list. I ask my students what would happen if they took to kindergarten a lollypop and gave it to one child? What would the others say? Where is mine? Try taking away long provided benefits from a privileged group, as for example food stamps, and see how popular you are with that voting group in the next election.

So why does the government now need a fifth of everything you make and it is still not enough? Answer, because we went off the listed powers of the Constitution and every departure required more taxpayer funding. The solution to less tax is less government. A side benefit is more freedom. The productive classes would not be hurt. Seldom do they qualify for the federally subsidized programs anyway.

The fifth taken from the productive classes would be spent by them creating a haven of jobs for those who wished to work. The cycle of dependency would be drastically reduced. The federal government would no longer be an enabler to those not working. States would decide for themselves what assistance programs they could afford with some states offering more and others less as the Tenth Amendment mandates.

So, how did we cover the expenses of the federal government—even wars—our first 124 years? Products coming into the country were assessed a fee to market in the U.S. called a tariff. We got product producers in other countries to cover our national expenses and thus we were able to spend on ourselves every cent of what the federal government now takes, which inadvertently stimulated the economy. No one should be able to argue that our exceeding $22 trillion national debt is fair, has really worked for any of us, and is a better plan. I personally like the idea of being able to purchase a new car every other year.

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.

Apr 9, 2019 | Economy, Liberty Articles

Harold Pease, Ph. D.

In the current College Admission Scandal some Hollywood actors have paid bribe money to get their children admitted into some prestigious institutions for which they are not qualified to attend. But colleges have been on the defensive for some time for reducing campus free speech, at least for conservatives and constitutionalists, giving predominantly one side of issues, and becoming bastions of progressive—even socialist—politics. Now they are accused of racketeering their students with devastating student loan debt.

The most recent accusation was made by Tucker Carlson March 18, 2019. Most of what he shared I witnessed as a full time faculty member for forty years. In remarks entitled “Fixing America’s $1.5T Student Loan Mess” he noted that student loan debt is now larger than “the entire GPA of Spain, of Sweden or any of the 54 countries in Africa. Apart from mortgages student loans are the biggest source of personal debt in this country, more than car loans and credit card bills.” It is enough debt, he says, “to stunt the entire generation of young people.”

Today the average college graduate owes $37,000 up from $20,000 just 13 years ago. “Student debt is rising far faster than the earnings of the American workers…” For law school graduates it is $110,000 and for medical school graduates it is nearly $200,000. Carlson adds, “Over all, two million Americans owe over $100 grand in student loans. Imagine starting life that far behind.” Many with this debt never finished a degree. “Instead of improving their life by attending college they wind up poorer and in bondage. And not just a few of them but millions and millions of them.”

But students do not have to go to college or incur this debt. Aren’t they alone responsible? No! The culture tells them at an early age that college is the ticket to prosperity and self worth. This is reinforced by parents. Going to college is also promoted by the universities as it justifies their positions and campus expansion. It is mostly about money and numbers.

So why blame the colleges? “Right now the federal government allows young people to take out an almost unlimited amount in student loans. Colleges know this, of course, and they hike their tuition to capture as much of that money as they can. Young people have little choice but to go along with it. Colleges control access to the credentials that we are all convinced are necessary, mandatory, to achieve success in the modern economy.” This is why Carlson calls it a racket. “These are the gate keepers of modern society and are ripping up every kid who passes through those gates.”

But this is only a part of the racket? The colleges and universities promote powerful lobbyists who swarm Washington for more unlimited student loan monies from which they benefit. Instead of lowering tuition they use the money to hire mostly more administrators and build more buildings. “From 1987 to 2012 the number of administrators on college campuses more than doubled. It’s far bigger than the increase of actual students going to college. College administrators routinely make 6 figure salaries…. College presidents often get 7 figure salaries. Their pay is probably the only thing in America rising as fast as tuition costs.” Essentially they are getting richer at student loan expense. They also have hired massive staffs.

Where else does the racket money end up? Carlson invites us to “Drive through rural America and see how well they have done. In a sea of poverty and despair you will notice gated islands of affluence. These are colleges. Outside the gates people are unemployed and dying of opioid overdoses. Inside the gates it looks like the rift on south beach. If you haven’t been to an American university lately, see it for yourself. Everything is new. There has been a building boom under way for decades on campuses. All of it funded by debt that is destroying a generation of American kids.”

So what is the answer? Require colleges to co-sign student loans—to share the liability. Right now “colleges get rich no matter what happens to the kids. Kids are on their own. If students get a degree and a decent job and repay their loan that’s great. But if they drop out of college and their degrees turn out to be worthless, as so many are, and they can’t repay what they have borrowed. So what! Colleges don’t care. They have no stake in the outcome. Colleges get all the benefits and none of the risks. That is the definition of a scam…. It should not be legal.”

If colleges had to co-sign for loans and be liable for defaulted loans they would implement checks on eligibility for the loans. These might include higher GPA requirements for loans, or loan amounts based upon previous success. As more than fifty percent of students drop out of college the first two years, government financed loans might be limited to junior and above levels of college when natural law has already identified those who are ready and will benefit from college. The truth is no one should get a loan to go to college until he/she is self disciplined enough to stick and have some idea what field is attractive to them and why.

What Carlson has portrayed I have seen.

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.

Feb 26, 2019 | Constitution, Economy, Healthcare, Liberty Articles, Taxes

By Harold Pease, Ph. D.

Our national debt just exceeded 22 trillion dollars. To pay this debt today each citizen owes $67,033. Since children pay no taxes, nor do about 45% of our adult population, each taxpayer actually owes $179,908. Our largest creditors in order are: Medicare/Medicaid $1,091,280,000,000, Social Security $1,005,651,000,000, Defense/War 676,814,000,000, Income Security (welfare) $293,531,000,000, Net Interest on Debt $350,206,000,000, and Federal Pensions $272,980,000,000 (USDebtClock.org).

Even with the present robust Trump economy (the best in several decades) this cannot continue to escalate. We are on a collision course with Armageddon which, at this late date, may not be avoidable. Any hope depends on three things (1) our ability to make significant cuts in the top six expenditures noted above, (2) our not electing a big spending congress or president in the next decade, (3) our not entering into any new big funding events such as war, infrastructure overhaul, or open borders allowing new groups to “eat out our substance” without having already paid their way.

Of this enslaving debt, four trillion comes from eight years of George W. Bush and ten trillion from eight years of Barack Obama—the two biggest spending presidents in U.S. History. Obama alone accumulated more debt than all previous presidents put together. Donald Trump is responsible for over two trillion dollars in two years.

So what is a trillion dollars? To begin with a trillion is the number one followed by twelve zeros. A trillion dollars is a thousand billion and a billion is a thousand million. This still means very little to students who count their money in fives, tens and twenties.

One mathematician gave us a more practical way to evaluate our outstanding debt. One trillion, one-dollar bills stacked atop each other (not end to end but flat) would reach nearly 68,000 miles into space—a third of the way to the moon (See CNN News Cast, Feb. 4, 2009). If so, the debt incurred under President Obama alone, $10 trillion, would have reached the moon and back and to the moon again. Moreover, if you like traveling atop this stack of ones, our total $22 trillion in debt would take you to the moon and back three times and to the moon a fourth time and a third of the way home again.

I ask students, “Who gets to go without so that this debt can be paid?” “Go without!!!?” That is a concept foreign to this generation!! They do not know, and neither do their parents and grandparents who laid it on their backs. When they are told that their share of the debt is $67,034 and up to $179,908, depending on how many of their fellow non taxpayers they can get to pay their fair share (see USDebtClock.org), due immediately, they are angry. Someone should have told them that government handouts are not free.

The 13th Amendment ending slavery has been rescinded, they are America’s new slaves. Bondage was given them before their birth, or while still in the womb, or before they were old enough to know what it meant to be sold into slavery. The past generation wanted nice costly programs for free and were willing to sell their children in order to have them.

The latest new theory to avoid fiscal responsibility and continue unlimited spending, used by Bush in late 2009 and Obama thereafter, is referred to as Quantitative Easing. Crudely it means printing more money out of thin air to cover our debt, but it is far more sophisticated than that. For Bush the money supply was greatly expanded by having the Federal Reserve purchase $600 billion in mortgage-backed securities (Harding, Robin. 3 November 2010, Quantitative Easing Explained. Financial Times). Obama purchased $600 billion of Treasury securities over a six month period of time beginning in November 2010 in what has been called Quantitative Easing or QE2 to distinguish it from QE1, the Bush expansion of the money supply (Cesky, Annalyn,3 Nov.2010, “QE2: Fed Pulls the Trigger” CNNmoney.com. Retrieved 10 Aug. 2011).

The biggest problem with expanding the money supply is that it reduces the value of the money that you have in your pocket. Prices go up. My Camaro, purchased in 1968, cost $2,700, purchased today at least ten times as much. In this instance money has lost 90% of its value since 1968. Those on fixed incomes are robbed as surely as if a thief had lifted their wallet or purse. They cannot return to their employer for a raise to compensate for the loss caused by their own government.

Still, with all the sophisticated “doublespeak,” as for example quantitative easement, it means that we will print whatever money we need to purchase whatever we wish. Neither party is serious about stopping the debt and removing the bondage that we are imposing upon our children and grandchildren.

Democrats propose “free” college and a salary for everyone, whether they work or not, under their proposed Green New Deal. Donald Trump’s proposed trillion-dollar infrastructure program, also does not suggest a change. Who cares if our debt of dollar bills stacked upon one another can go to the moon and back almost four times so long as the government fills our stomachs and, in the case of Obama, purchases our cell phones

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.

Feb 18, 2019 | Constitution, Economy, Liberty Articles, Taxes

(Presidents’ Day, Article)

By Harold Pease, Ph. D

Perhaps America’s most beloved and respected president was Abraham Lincoln, who now shares a national holiday—Presidents Day—with George Washington. Today most Democrats would oppose him, as they once did in 1860. He opposed slavery and socialism. He saw nothing in the Communist Manifesto, published in 1848, worthy of emulation.

On the ownership of property Abraham Lincoln’s feelings were especially strong, he said, “Property is the fruit of labor; property is desirable; is a positive good in the world. That some should be rich shows that others may become rich, and hence is just encouragement to industry and enterprises” (The Collected Works of Abraham Lincoln edited by Roy P. Basler, Volume VII, pp. 259-260). Lincoln might have added “which produces jobs for those not rich.”

To him there was no need to take by force the wealth of those who produce and give it to those less productive, as has always been the prescription of socialism. The “share the wealth” philosophy of socialism brought on by “envy politics,” so articulated by the Democratic Party today, was a foreign ideology to the Civil War president, who had read and rejected Karl Marx’s Communist Manifesto.

The answer to ending poverty is not class envy, first identified by Aristotle some 2,500 years ago as being the natural inclination of those with less, a philosophy implemented by Lenin in Russia when the communists identified those holding property as enemies of the state and liquidated some four to eight million farmers, the “Kulaks” (“The Russian Kulaks,” InDepthInfo.com). Then, they wondered why the country had such a horrific famine in 1921-1922 when millions starved.

No money was set aside for, or provided to, any class or special interest group in our Constitution. The power distributed benefited all equally and at the same time. The federal role was as referee only. Our Constitution does not redistribute wealth; it leaves the individual to do that for himself by his work ethic. It remains the fairest way.

Will income inequality be the outcome? Yes! Free men are not equal and equal men are not free. But all will have more under capitalism than had we instead forced income equality by taking from those who produce and giving it to those who do not. We remain anxious to share our wealth producing philosophy with our less prosperous neighbors and the world so that all can have more, but individuals stealing it from us, or using the government to do it for them, known as legalized plunder, is just wrong and disincentivizes those who produce.

Lincoln’s answer to the poor, from which he sprang himself, “Let not him who is houseless pull down the house of another, but let him labor diligently to build one for himself, thus by example assuring that his own shall be safe from violence….” Unfortunately, many in our society have forgotten the “labor diligently” part of his phrase and have come to expect the government to provide, from the industry of others, their every need. On that score Lincoln said sarcastically. “You toil and work and earn bread, and I will eat it.” He viewed this principle as a form of tyranny/slavery on those who work. Today approximately 47% of the adult population pay no federal income tax; many actually receive benefits for which they have paid nothing.

Watching others acquire wealth was, in fact, a sign of a healthy economy for Lincoln. “I take it that it is best for all to leave each man free to acquire property as fast as he can. Some will get wealthy. I don’t believe in a law to prevent a man from getting rich; it would do more harm than good.” Nor would he have supported the hundreds of laws that we have today that disincentivizes a man trying to acquire wealth.

His view sounds similar to those expressed by President Trump in his 2019 State of the Union Address. “Here, in the United States, we are alarmed by new calls to adopt socialism in our country. America was founded on liberty and independence — not government coercion, domination and control. We are BORN FREE, and we will STAY FREE. Tonight, we renew our resolve that America will NEVER be a socialist country.”

The new calls for socialism in our country referenced above were recently dropped by Rep. Alexandria Ocasio-Cortez’s long-awaited Green New Deal endorsed by recently announced Democratic presidential candidates, Senators: Kamala Harris, Elizabeth Warren, Cory Booker and Kirsten Gillibrand seemingly each attempting to “out socialize” opponents.

Paying the estimated $7 trillion price tag required would result in a 90% tax take which, ironically, is the definition of slavery—the very thing Lincoln is credited as having ended. It would end air travel and radically effect every other aspect of life. It would also redistribute vast new sums of less valued printed paper money making all equally poor.

Socialists may hate the “Walmarts” or the “McDonalds” all they want, but these provide the poor tens of thousands of jobs. Do not bite the hand that feeds you, then wonder where the jobs and prosperity went, as did the early Russian socialists. The “share the wealth” philosophy, which Lincoln opposed, and endorsed now by the Democratic Party, has never brought long term general prosperity for any people, any place, or any time.

Dr. Harold Pease is a syndicated columnist and an expert on the United States Constitution. He has dedicated his career to studying the writings of the Founding Fathers and applying that knowledge to current events. He taught history and political science from this perspective for over 30 years at Taft College. Newspapers have permission to publish this column. To read more of his weekly articles, please visit www.LibertyUnderFire.org.